Main Description

The Portfolio Rotational Momentum Tool allows users to see the hypothetical results of a momentum or relative strength rotation ranking investing strategy applied to entire portfolios instead of individual funds [aka the regular Rotation Momentum Tool], with the option of adding in adaptive asset allocation, using strength calculations including momentum, volatility, Sharpe Ratio, and Information Ratio. The Portfolio Rotational Tool will automatically calculate the strength, based on the momentum, volatility, mean reversion, downside volatility, Sharpe Ratio and/or Information Ratio, and at the end of each update period, switch or rotate to the highest ranked portfolio for the next period, also results are shown for the scenario of switching portfolios only when a portfolio has dropped below a specified rank scoring. If more than 1 portfolio is selected each period the user has the option to use adaptive asset allocation on the selected portfolios.

Portfolio Rotation vs. Other Rotation Tools

The Portfolio Rotation Tool looks at the strength of an entire portfolio defined by the user, and then selects the strongest portfolio(s) based on the rotation settings. This is a rotation tool applied to entire portfolios instead of just individual funds. The ordinary Rotation Tool applies its’ strength filters and judgments to individual funds, this tool applies these calculations to entire portfolios consisting of as many as 20 symbols.

Settings

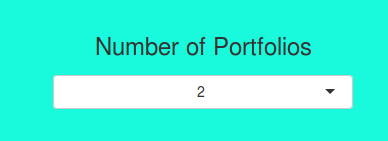

Enter the number of portfolios you would like to rotate between. Users can setup different funds in each portfolio in the tabbed section below this box. The strategy will then select the strongest portfolios as the winners and invest in that portfolio each period.

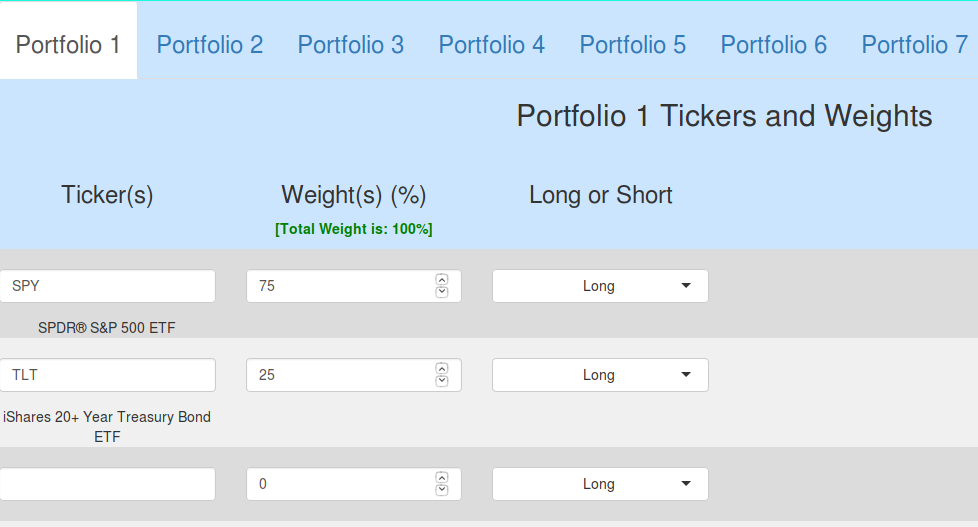

In this tabbed section users can define up to 20 tickers per portfolio. The strongest portfolios will be chosen each period. Use the tabs named ‘Portfolio 1’, ‘Portfolio 2’… to switch between portfolios.

Example Strategies and Settings

Stocks and Bond Rotation

Description: This strategy rotates between a 75/25 stock/bonds and a 50/50 stock/bonds and a 25/75 stock/bonds portfolio based on which one of these portfolios is strongest.

[3 Portfolios Enabled]

Portfolio 1: SPY at 75%, TLT at 25%

Portfolio 2: SPY at 50%, TLT at 50%

Portfolio 3: SPY at 25%, TLT at 75%

All other settings default.

RotationInvest.com is not a registered investment advisor and does not provide professional financial or investment advice. RotationInvest.com is a tool that produces trade signals and backtesting results according to the set of funds and rules provided for analysis. Any strategies shown including but not limited to the pre-built strategies are only used to highlight what is possible using these tools, they should be regarded as educational in nature only, and not investment advice.