Strategy of Strategy – Combine Tool

The Combine Tool is provided to allow users a way to easily and quickly see how multiple strategy portfolios performed together. For example you may develop an asset allocation, moving average, and rotational strategy that you think compliment each other well, with the Combine Tool you can upload the daily equity export for each strategy and select different weightings for each upload to view the combined performance and make real assessments as to how well each portfolio complimented the others.

Strategy of Strategy – Moving Average Tool

The Portfolio Moving Average Tool allows users to upload a ‘stock’ and a ‘cash’ portfolio from our other tools output section, when the ‘stock’ portfolio’s equity curve is below the defined moving average, the ‘cash’ portfolio is invested in instead of the ‘stock’ portfolio.

Strategy of Strategy – Rotation and Adaptive Asset Allocation Tool

The Rotation and Adaptive Asset Allocation Tool allows users to upload up to 10 strategies equity curves from other apps and rotate or apply adaptive asset allocation to these strategies, so you can determine when and how much each strategy gets invested in. The settings on this tool are very similar to our Advanced Rotation Tool.

Settings

Step 1: Build strategies you would like to test with our ‘Strategy of Strategy’ tools in any of our other tools.

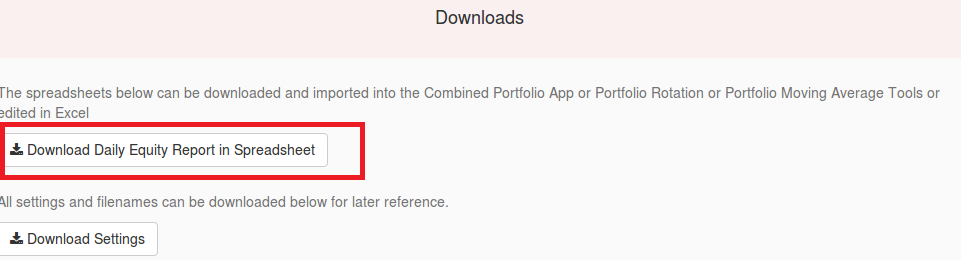

Step 2: Download the equity spreadsheet. Be sure not to re-save file once downloaded as Excel reformats spreadsheets.

Step 3: Once you have downloaded all the strategies you would like to to test with our strategy of strategy tools, proceed to the settings section for instructions on how to upload these files (below).

SETTINGS - COMBINE TOOL

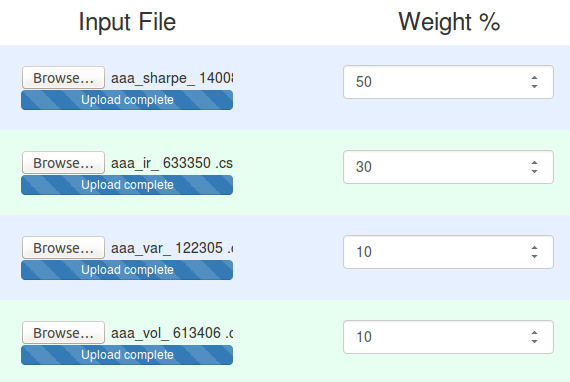

File Upload List

Upload up to 25 separate equity curves to be tested. If the files have different start and/or end dates don’t worry, the output will show only results when all equity curves have data available. Important Note: Once you save the daily equity report from another tool, do not open and save it using Excel, the formatting becomes damaged and will not longer work with the Combined Tool! If you want to use the Combine Tool save a daily equity report file, do not open it or save it, then upload it to the Combine Tool.

Weight List

Enter a corresponding weight value in percent for each file uploaded. If a 50 is entered on line 1, and a file for a Rotational Backtest is uploaded for file #1, this means that 50% of the portfolio will be composed of the Rotational Backtest uploaded in file #1. The total weight of all portfolios is displayed all the bottom of the settings area near the Run Backtest button, this button will show you the total weighting % of your portfolio, values over 100% (leveraging) is allowed.

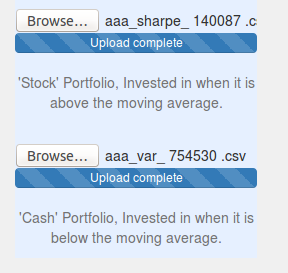

SETTINGS - MOVING AVERAGE TOOL

Upload a Stock and Cash Portfolio

This section allows you to upload a stock and cash portfolio. Instead of entering a stock and cash ticker like the traditional moving average tool, this tool applies moving averages to an entire portfolio that comes from any one of our tools equity download outputs (csv file). Keep in mind these are downloaded from each tool’s equity download section, and must not be edited before uploading to our tools. All other settings and outputs below work just like the normal Moving Average tool.

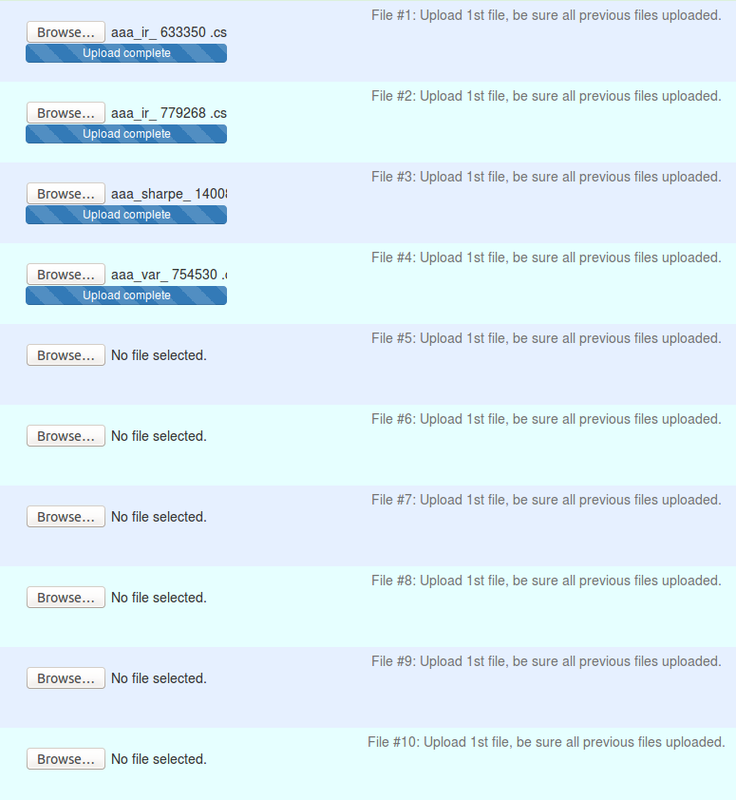

SETTINGS - ROTATION AND ADAPTIVE ASSET ALLOCATION TOOL

Upload a Equity Portfolio’s to the Tool

This section allows you to upload up to 10 different portfolio’s to be apply rotation or adaptive asset allocation on. Instead of entering a list of tickers like the traditional rotation tool, this tool applies the advanced rotation tool to an entire portfolio that comes from any one of our tools equity download outputs (csv file). Keep in mind these are downloaded from each tool’s equity download section, and must not be edited before uploading to our tools. All other settings and outputs below work just like the normal Advanced Rotation Tool.