Main Description

The Adaptive Asset Allocation Tool allows users to see the hypothetical results of weighting assets in your portfolio based on performance metrics such as Maximum Sharpe Ratio, Maximum Information Ratio, Minimum Variance, and Minimum Volatility instead of using fixed percentages. On each period update the adaptive asset allocation tool updates the weight of each fund entered based on it’s weighting score, thus allowing your portfolio to adjust to changing market conditions by re-weighting the portfolio instead of buying and selling a list of symbols. You can think of these weightings like portfolio rebalancing, but instead of using a fixed percentage, a score based on past performance will determine the optimal weight for each ticker entered to maximize or minimize the desired weighting method.

Settings

Select Data Feed

Select a data feed to use. The Universal Data Feed has been our default data feed, and provides stock, ETF, and mutual fund data for the US and non-US markets. The Professional Quality Data Feed provides high quality data for US stocks, ETFs, and mutual funds. Additionally there is an option to select historical data, which allows users to select funds with histories that go back as far as 1924.

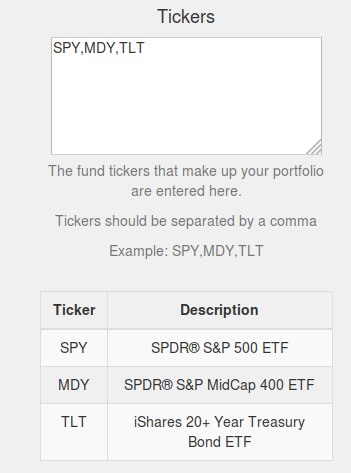

Enter Tickers

Enter an unlimited number of almost any stock, ETF, or mutual fund ticker into Tickers list separating each ticker by a comma. Each ticker entered will be available to choose based on if it’s position score is high enough.

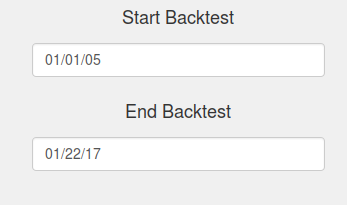

Start/End Simulation Date

The date values to start and end the simulation. If a ticker is unavailable for some of the date range entered the default behavior will be to only test the dates when all tickers are available.

Frequency of Updates

This setting allows the user to choose how often the conditions are evaluated and updates to allocation are made. For example a monthly update means once a month (at the end of the month), the back tester calculates the new weight values based on each one of the 5 algorithms and adjusts the weightings of each ticker to match the weightings reported by each of the algorithms. These weightings will be held until the end of next month when the back tester will evaluate (ask the question) again and re-weight the portfolio according to the new values for each algorithm.

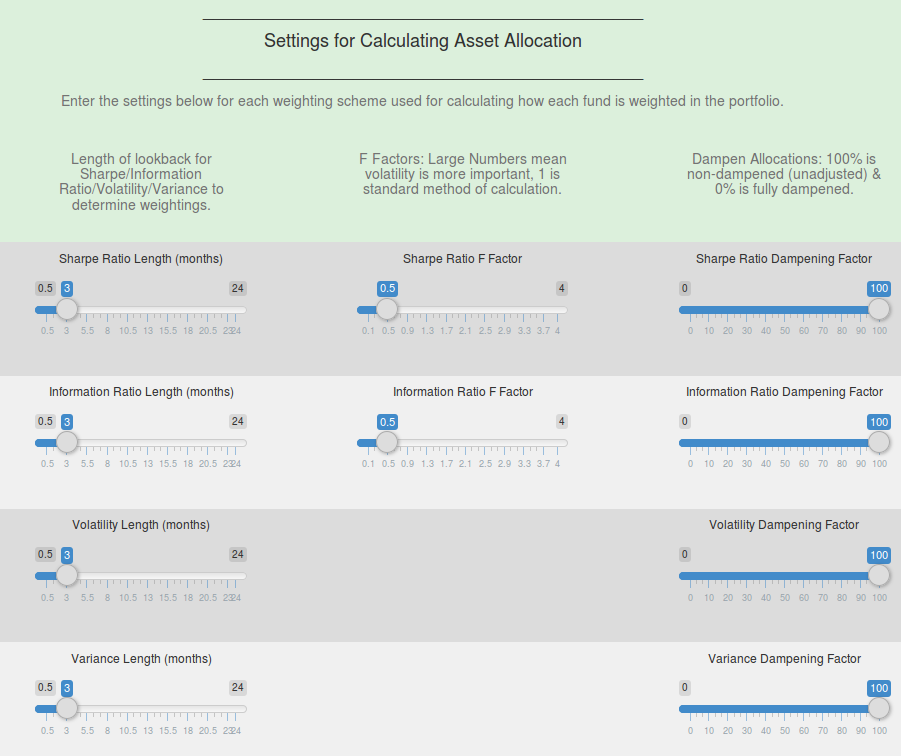

Settings for Calculating Asset Allocation

(Only Available in Advanced Rotation Tool)

If you are investing in more than 1 symbol you may decide to use asset allocation to decide how much of each symbol to invest in. The default setting is equal weighting for all symbols, but you may choose to maximize Sharpe Ratio, maximize Information Ratio, minimize Volatility, minimize Variance, and maximize the position score used to determine how much the weighting is for each fund.

Lookback Lengths

For each of the weighting algorithms the lookback length can be adjusted. This setting will control the number of months the Sharpe Ratio, or Information Ratio, or Variance, or Volatility will be calculated on to determine the weighting of the funds.

F Factor

The F factor can be adjusted for the Sharpe Ratio and Information Ratio. This setting allows the user to adjust how important volatility is in the calculation of the Sharpe Ratio and Information Ratio. A setting of 0 means volatility is disregarded, a setting of 1 is the standard way these ratios are calculated, and a setting of more than 1 means the the volatility is becoming more and more important to the calculation.

Dampening Allocations

Dampening Allocations limits the full affect of the weighting algorithm. For example the Sharpe Ratio calculation will often cause allocations to go to 0% if the value is negative for that period, this may be undesirable; a lower dampening ratio will cause the minimum allocation to be >0% so a fund will not be totally absent from your portfolio, the full effects of the Sharpe Ratio will thus be “dampened”. A dampening ratio of 100 means the the dampening is off (the weighting algorithm can operate without interference). A dampening ratio of 0 means the maximum dampening will be applied to the portfolio, at 0 the weightings will not be far from an equally weighted portfolio.

Save Your Settings For Later

At the bottom of the settings area there is a URL, bookmark or save this URL and you will automatically be able to load and save all your settings automatically, without re-entering it every time.

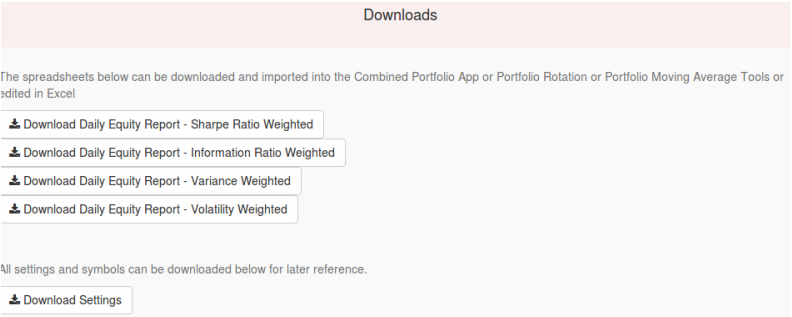

Downloads

Downloads that are available are a full trade spreadsheet, day by day strategy equity spreadsheet (which can be uploaded to any of our portfolio combination tools), and a list of settings you used to create the results. You may also download an HTML report with fully interactive graphs that you can save and send to others.

Example Strategies and Settings

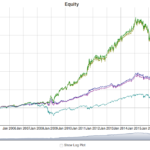

Asset Allocation Tool – Simple Allocation Strategy

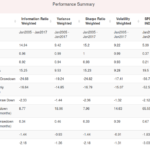

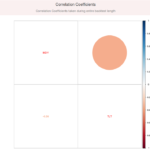

This strategy allocates equity between SPY, MDY, TLT, and IEF tickers. This strategy is a very simple allocation between 2 stock ETFs and 2 bond ETFs, the idea is to rotate mainly to bonds during market crashes and mainly to stocks when the stock market is doing well. Using 2 stocks and bonds allows asset allocation to slowly taper in the amount (aggressiveness) of the asset allocation.

Settings for Members: Using the Sharpe Ratio based weighting, 3 month Sharpe length, F Factor for Sharpe of 0.9,

dampening factor of 90% on the Sharpe Ratio

Asset Allocation Tool – Bond Allocation Strategy

This strategy allocates equity between AGG, TLT, BND, CWB, and IEF tickers. This strategy is a bonds only strategy, and provides very low volatility and drawdown (safety) with better returns and drawdown numbers than the classic equally weighted portfolio or the single bond fund buy and hold approach.

Settings for Members: Using the Information Ratio based weighting, 3 month Information Ratio length,

F Factor for Information Ratio of 0.5, dampening factor of 90% on the Information Ratio

Asset Allocation Tool – High Return Allocation

This strategy allocates equity between MDY, ZIV, TLT, and SHY tickers. This strategy allows investment in very high performing (and very volatile funds) as well as lower volatility options such as SHY. Adaptive Asset Allocation allows reducing allocation in the very high volatility funds when they are expected to perform poorly and ramp up the exposure as market conditions improve.

Settings for Members: Using the Information Ratio based weighting, 3 month Information Ratio length,

F Factor for Information Ratio of 0.5, dampening factor of 90% on the Information Ratio

RotationInvest.com is not a registered investment advisor and does not provide professional financial or investment advice. RotationInvest.com is a tool that produces trade signals and backtesting results according to the set of funds and rules provided for analysis. Any strategies shown including but not limited to the pre-built strategies are only used to highlight what is possible using these tools, they should be regarded as educational in nature only, and not investment advice.